GREA Closes Power Properties Portfolio, Most Sought After Multifamily Portfolio in Dallas, TX

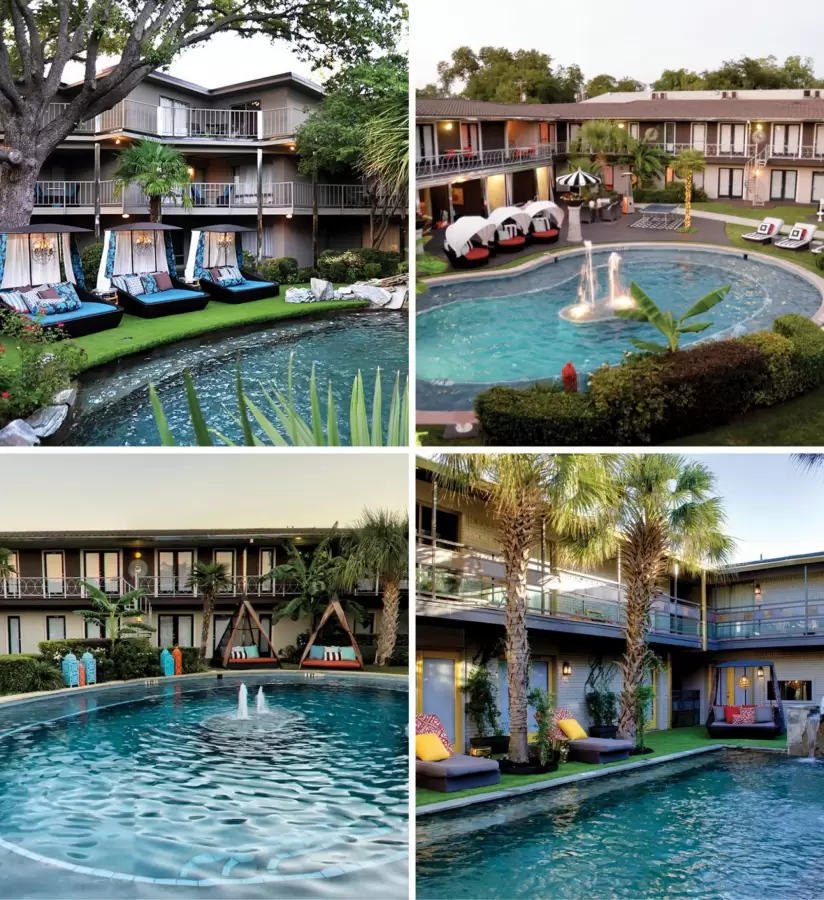

GREA, specializing in serving institutional and private real estate investors of multifamily assets, is pleased to announce the sale of The Power Properties Portfolio, an iconic 20-property multifamily portfolio located in Old East Dallas that includes the esteemed historic neighborhoods of Swiss Ave, Lakewood, and Peak Suburban. The 544 units were constructed between 1914 and 1962. The resort-style communities were impeccably renovated in the mid-1990s through the early 2000s. They were assembled by two brothers who are recognized as the original urban pioneers of East Dallas. Together, they worked to maintain the historical integrity of the buildings while infusing modern amenities and providing residents with a unique resort-style living experience. A broad range of architectural themes can be seen throughout, from Old-World Spanish influences, classic 1920s era Art Deco, New York brick buildings, Mid-Century Modern, French Quarter, Festive Contemporary, and Modern European touches.

"Our team started working on the 20-property portfolio 3+ years ago, and it was one of the most challenging and rewarding transactions of my 23-year career. The Broker team, including Ryan Quaid, Buck Poderski, Byron Griffith, and myself, toured dozens of investors through over 500 units and procured eighteen qualified offers by personally connecting with potential investors through thousands of calls and in-person meetings," said Todd Franks, Founding Partner of GREA and Listing Broker of The Power Properties Portfolio.

GREA ultimately achieved a 105.4% list-to-close ratio on this Receivership sale through a complex marketing structure that included a stalking horse agreement to set a floor on offers before the properties were opened to the broader investor market. The stalking horse agreement was a bold move: If GREA did not achieve a minimum price through marketing, they committed to purchase the portfolio themselves for that price. "This is unprecedented in the current macro-economic conditions," said Griffith. "Interest rates increased 100bps from when the LOI was executed with the ultimate Buyer to the close of the contract. In addition, the lender cut the loan proceeds over 12% the week before the original closing date," explained Poderski. Franks went on to say: "I believe we chose the best buyer; it took a local group to understand the historical significance of the assets, the value-add opportunity, even the value of the land alone."

The Seller was a Court Appointed Receiver, but the properties were not economically distressed; it was a partnership divorce.

The Buyer is 180 Multifamily, a DFW-based investor specializing in value-add assets throughout Texas.